Understanding Advanced Trading Platforms: A Detailed Overview

Trading platforms play a crucial role in helping traders analyze markets, execute trades, and manage risk efficiently. With advancements in technology, modern trading platforms provide sophisticated tools, automation capabilities, and user-friendly interfaces to enhance trading performance. This article explores the key features and benefits of advanced trading platforms and what traders should consider when choosing the right one.

Key Features of Advanced Trading Platforms

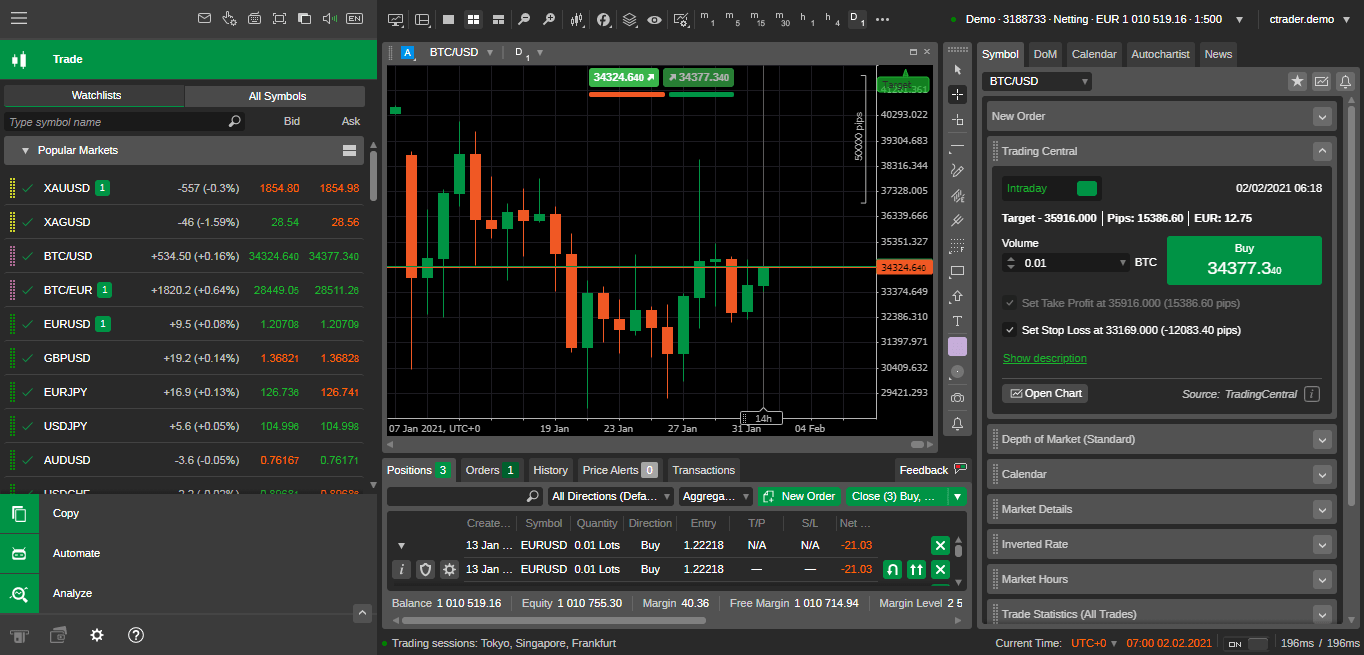

A high-quality trading platform should offer a seamless experience, ensuring smooth trade execution and comprehensive market analysis. One of the widely recognized platforms that provides such features is cTrader, known for its intuitive design and advanced trading functionalities.

Some of the key features to look for in a trading platform include:

1. User-Friendly Interface

An effective trading platform should have a clean and well-organized interface, making it easy for traders to navigate. Whether a beginner or an experienced trader, having a customizable layout and intuitive controls helps streamline the trading process.

2. Advanced Charting Tools

Modern trading platforms come equipped with a variety of charting tools, indicators, and drawing tools to help traders perform in-depth market analysis. Customizable timeframes, multiple chart types, and the ability to overlay technical indicators contribute to more precise trading decisions.

3. Algorithmic and Automated Trading

Automation has become a significant aspect of trading. Many advanced platforms support algorithmic trading, allowing traders to develop and deploy automated strategies. Features such as backtesting, scripting, and trading bots enable traders to optimize their strategies for better efficiency.

4. Real-Time Market Data and Analysis

Accurate and timely market data is crucial for traders to make informed decisions. A powerful trading platform provides real-time price updates, economic news, and advanced analytics to help traders stay ahead of market movements.

5. Risk Management Tools

Risk management is essential for long-term trading success. Advanced trading platforms offer tools such as stop-loss, take-profit, and trailing stop features to help traders manage their exposure effectively. Some platforms also include risk calculators to determine position sizing and leverage options.

6. Multi-Device Compatibility

With the increasing need for mobility, a trading platform should be accessible across different devices, including desktops, tablets, and mobile phones. Cloud-based synchronization ensures that traders can monitor and manage their trades from anywhere in the world.

Choosing the Right Trading Platform

When selecting an advanced trading platform, traders should consider the following factors:

1. Execution Speed

Fast and reliable trade execution is critical, especially in fast-moving markets. A platform with low latency ensures that traders can enter and exit positions with minimal slippage.

2. Customization Options

Every trader has unique preferences, so the ability to customize charts, layouts, and alerts enhances the trading experience. Platforms that allow traders to personalize their workspace can significantly improve efficiency.

3. Security and Reliability

A trading platform must provide top-notch security measures to protect user data and transactions. Encryption protocols, two-factor authentication (2FA), and regulatory compliance contribute to a secure trading environment.

4. Access to a Variety of Instruments

A good platform should support a range of trading instruments, allowing traders to diversify their portfolios. Whether focusing on commodities, indices, or other financial instruments, access to multiple markets enhances trading opportunities.

5. Support and Community Engagement

Having access to a responsive customer support team and an active trading community can be beneficial. Platforms with educational resources, discussion forums, and dedicated support teams help traders stay informed and solve any issues efficiently.

Conclusion

Advanced trading platforms are essential for traders looking to optimize their strategies and enhance performance. With features like algorithmic trading, real-time data, and risk management tools, these platforms provide the necessary resources for efficient trading. By carefully evaluating factors such as execution speed, security, and customization options, traders can select the platform that best suits their needs.