401k Plan Tax Credits: A Comprehensive Guide for Employees

Are you aware of how 401k plan tax credits can benefit you? These credits are designed to encourage employees to save for retirement.

With the right knowledge, you can amplify your contributions and enhance your savings. Understanding these tax incentives is crucial for maximizing your retirement funds.

In this guide, we’ll break down everything you need to know about 401k tax benefits. You’ll learn who qualifies and how to make the most of these financial tools.

Let’s explore the pathway to a more secure financial future together! Keep on reading!

What is a 401k Plan?

A 401k plan is a retirement savings account provided by your employer. It lets you save a part of your paycheck before taxes, which means you pay less in taxes now. Some employers even match your contributions, giving you extra money for your retirement.

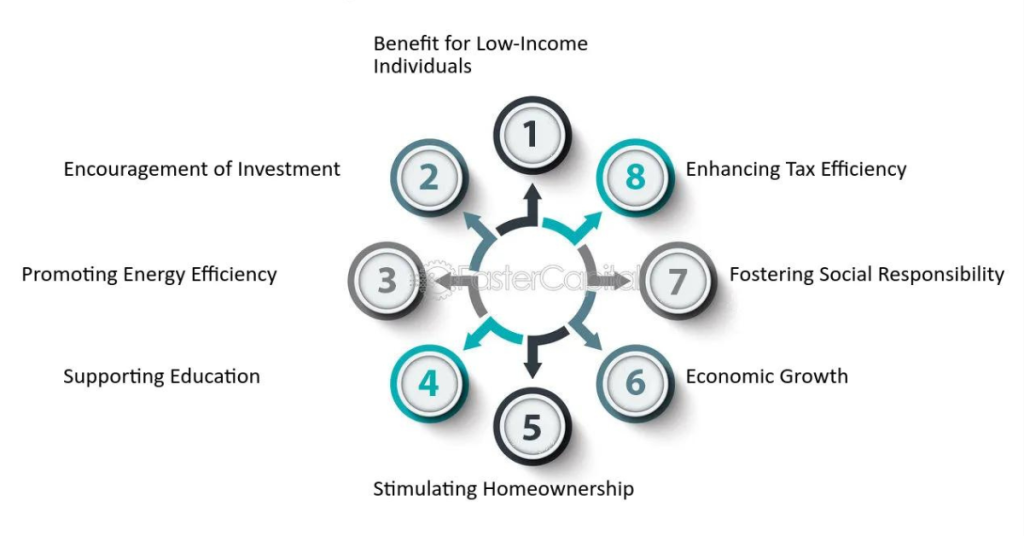

The Importance of Tax Credits

Tax credits are great benefits for employees who join 401k tax incentives. They can lower the amount of tax you have to pay, which is especially helpful during tax season. Knowing about these tax credits can help you increase your contributions and save more for retirement.

Types of Tax Credits Available for 401k Participants

Employees can take advantage of some tax credits when they put money into a 401k plan. One important credit is the Saver’s Credit, which helps eligible taxpayers who save in a retirement account.

This credit encourages lower- to middle-income workers to save for their future. Another benefit is that your money can grow without being taxed until you take it out during retirement.

Eligibility Requirements for Tax Credits

To qualify for the Saver’s Credit, you need to meet some income and filing rules. Usually, this credit is for people with an adjusted gross income (AGI) below certain limits that may change each year. Also, to claim this credit, you should be at least 18 years old, not a full-time student, and not listed as a dependent on someone else’s tax return.

How to Claim Tax Credits for Your 401k Contributions

If you want to get tax credits for your 401k contributions, you’ll need to fill out IRS Form 8880. This form helps you figure out the Saver’s Credit based on how much you contributed and your income.

Make sure to keep track of your contributions and any money your employer adds, as you’ll need this information when it’s time to file your taxes. Understanding 401k benefits and the claiming process can significantly enhance your retirement savings strategy.

Maximizing Your 401k Contributions

Maximizing your contributions to a 401k contribution savings is a great way to save for retirement. Make sure to contribute enough to get your employer’s matching contributions, as this is like getting free money!

It’s important to check your finances regularly and adjust how much you’re contributing to meet your changing goals. By increasing your contributions over time, you can boost your retirement savings.

Read Also: Different Types of Insurance and How to Choose the Right Plan for Your Needs

Unlocking the Benefits of 401k Plan Tax Credits

401k plan tax credits are really important for helping employees save for retirement. When you learn about these credits, you can reduce your taxes while building your savings.

Joining a 401k plan not only helps your future but also teaches you about managing money. Don’t miss out on the Saver’s Credit and its eligibility rules.

Make the most of your contributions to fully benefit from 401k tax credits. Start making informed choices today for a secure financial future!

Did you like this guide? Great! Please browse our website for more!

One Comment